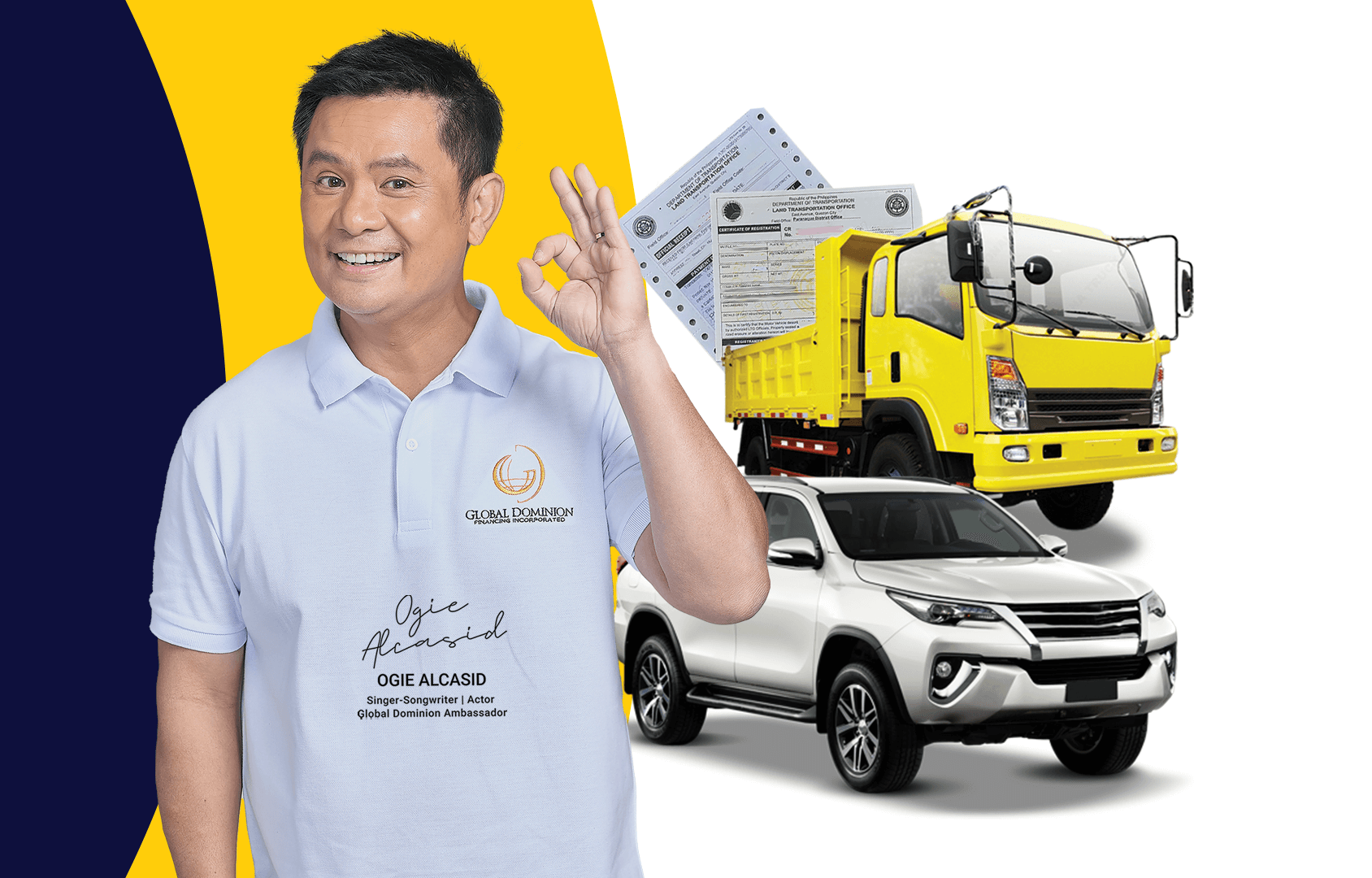

In times of financial need, many Filipinos look for practical ways to access quick cash without going through the long and tedious process of traditional bank loans. One ORCR sangla loan popular option is the ORCR Sangla Loan, a financing solution that allows car owners to use their vehicle’s Official Receipt (OR) and Certificate of Registration (CR) as collateral.

What is an ORCR Sangla Loan?

An ORCR Sangla Loan is a type of secured loan where the borrower pledges the OR/CR of their vehicle to a lending company in exchange for cash. Unlike traditional auto pawn loans, the borrower usually keeps and continues to use their car while the OR/CR documents are temporarily held by the lender as security until the loan is repaid.

Why Choose ORCR Sangla Loan?

Here are some key advantages of choosing this type of loan:

Quick Approval – Since the vehicle’s OR/CR is used as collateral, lenders can process applications faster compared to unsecured loans.

Keep Driving Your Car – Unlike a typical car pawn where the vehicle is surrendered, many ORCR sangla loan providers let you keep using your car.

Flexible Loan Amounts – The loan value is often based on your car’s market value, giving you access to a higher loanable amount.

Lower Interest Rates – Because the loan is secured, interest rates are generally lower than those of payday loans or credit card cash advances.

No Need for Perfect Credit History – Even those with poor credit scores can qualify, as the collateral reduces the lender’s risk.

How to Apply for an ORCR Sangla Loan

The process is simple and usually requires only a few documents:

Submit Application – Provide personal information and vehicle details to the lender.

Prepare Documents – Submit your vehicle’s OR/CR, valid IDs, and proof of income (if required).

Car Appraisal – The lender will assess your car’s value to determine the loanable amount.

Loan Approval & Release – Once approved, you can receive the cash in as fast as 24–48 hours.

Things to Consider Before Applying

While ORCR sangla loans are convenient, it’s important to keep the following in mind:

Choose a trusted lender – Make sure the company is legitimate and has clear terms and conditions.

Understand the repayment schedule – Always check interest rates, fees, and payment deadlines.

Pay on time – Failure to settle the loan may lead to repossession of your vehicle.

Final Thoughts

An ORCR Sangla Loan is a practical solution for car owners who need quick cash without giving up their vehicle. With fast processing, reasonable rates, and flexible terms, it offers a convenient alternative to traditional lending. However, borrowers should always ensure they deal with reputable lenders and review the loan terms carefully before signing.